summit county utah sales tax

Report and pay this tax using form TC-62F Restaurant Tax Return. Bids Request for Proposals.

Summit Wasatch County Utah Property Owners Are You Paying The Correct Property Taxes Park City Real Estate Agent Nancy Tallman

Businesses shipping goods into Utah can look up their customers tax rate by address or zip code at taputahgov.

. The entity that had the second highest swing was Summit County government. Lowest sales tax 61 Highest sales tax. County Jan-18 11917001 24238463 3737024 75292525 13963108 55689080 30979593.

Manage Summit County Funds. County County Public Transit. Access county bids and request for proposals.

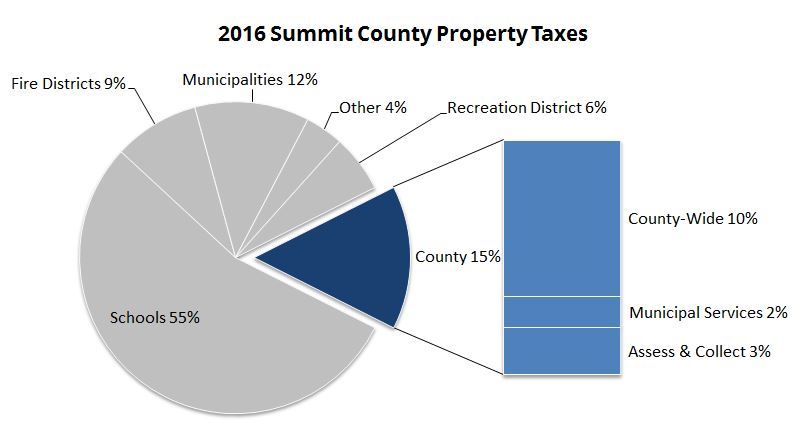

The Summit County Treasurer is responsible for the collection distribution and reconciliation of property taxes levied by all of the taxing entities in Summit County. The US average is 73. Access Utah sales and use tax rates on the Utah State Tax Commissions website.

2022 List of Utah Local Sales Tax Rates. The Combined Sales and Use Tax Rates chart shows taxes due on all transactions subject to sales and use tax and includes. Bars and taverns in Utah are also subject to restaurant tax on food sales and beverages including beer and liquor.

A county-wide sales tax rate of 155 is. Summit County Home Page. The US average is 28555 a.

Beer Alcohol Licensing. Integrates Directly w Industry-Leading ERPs. Utah Sales.

Utah Counties Beaver County Box Elder County Cache County Carbon County Daggett County Davis County Duchesne County Emery County Garfield County Grand County Iron County Juab County Kane County Millard County Morgan County Piute County Rich County Salt Lake County San Juan County Sanpete County Sevier County Summit County Tooele County. The Summit County sales tax rate is. The Utah state sales tax rate is currently.

The countys 2021 sales tax collections were up about 23 compared to 2019 and up about 35 compared to 2020. Utah has a 485 statewide sales tax rate but also has 208 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2053 on top of the state tax. See Utah Code 59-12-602 5 and 59-12-603 1 a ii Pub 55 Sales Tax.

State Local Option Mass Transit Rural Hospital Arts Zoo Highway County Option Town Option and Resort taxes. 6 rows The Summit County Utah sales tax is 655 consisting of 470 Utah state sales tax and. Tax Rates for Summit County - The Sales Tax Rate for Summit County is 78.

Ad Standardize Taxability on Sales and Purchase Transactions. The 2018 United States Supreme Court decision in South Dakota v. Income and Salaries for Summit County - The average income of a Summit County resident is 45461 a year.

The Treasurer is responsible for the banking reconciliation management and investment of all Summit County funds. Summit County in Utah has a tax rate of 655 for 2022 this includes the Utah Sales Tax Rate of 595 and Local Sales Tax Rates in Summit County totaling 06. Utah State Tax Commission Distribution of Sales and Use Taxes And Other Distributions Summit County CoCity 22000 Sum of Payment Tax Type Distrib Period Arts Zoo County Option E-911 Liquor Mass Transit Restaurant Sales Transient Room Addl Transit.

Complete the online building application. - Tax Rates can have a big impact when Comparing Cost of Living. Tax rates are also available online at Utah Sales Use Tax Rates or you can contact the Tax Commission at 801-297-2200 or 1-800.

The restaurant tax applies to all food sales both prepared food and grocery food. Utah State Tax Commission Distribution of Sales and Use Taxes And Other Distributions Summit County CoCity 22000 Sum of Payment Tax Type Distrib Period Arts Zoo County Option E-911 Liquor Mass Transit Restaurant Sales Transient Room Addl Transit. Summit County Utah Recorder-4353363238 Assessor-4353363211.

The Summit County Council established the Restaurant Tax Advisory Committee to investigate advise and recommend. The primary purpose of the Restaurant Tax Grant is to promote tourism as set out by the Utah State Statute and the County Council. The entire combined rate is due on all taxable transactions in that tax jurisdiction.

3 rows Summit County UT Sales Tax Rate The current total local sales tax rate in Summit County. To review the rules in Utah visit our state-by-state guide. 8 rows The Summit County Sales Tax is 155.

Has impacted many state nexus laws and sales tax collection requirements. Conference Room Policy PDF Flood Plain Maps. The Summit County 2021 Tax Sale will be held on.

- The Income Tax Rate for Summit County is 50. You can find more tax rates and allowances for Summit County and Utah in the 2022 Utah Tax Tables. The US average is 46.

Automating sales tax compliance can help your business keep compliant with.

Summit County Utah Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Utah Summit County Parcels Arcgis Hub

Summit County Utah Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Summit County Fair Posts Facebook

What Would Colorado Rivers Look Like Without Water Colorado River Water River

Park City Parade Of Homes Lane Myers Construction Utah Custom Home Builders Modern Lake House Mountain Home Exterior Dream House Exterior

How Healthy Is Morgan County Utah Us News Healthiest Communities

Logan Cache County Utah Genealogy Familysearch

What Would Our Co Rivers Look Like Without Water Water Resources Water Natural Landmarks

Research Shows Affordable Housing Developments Increase Property Values Nearby

Do You Make The Cash To Be In Utah S 1 Percent Cash Utah Investing

Washington County Utah Wikiwand

Your 2018 Summit County Utah Property Taxes Explained Park City Real Estate Agent Nancy Tallman

Utah Government And Society Britannica

Corporate Retention Recruitment Business Utah Gov

4106 W Sierra Dr Park City Ut 84098 3 Beds 3 5 Baths Park City Mchenry Great Rooms

Summit County Councilors Confident New Regulations On Rv Sites Are Necessary